- Home

- /

- Racism and Beyond: A...

- /

- A New Deal For...

- /

- Older Americans and the...

Older Americans and the New Deal

Scroll down for our photo gallery below!

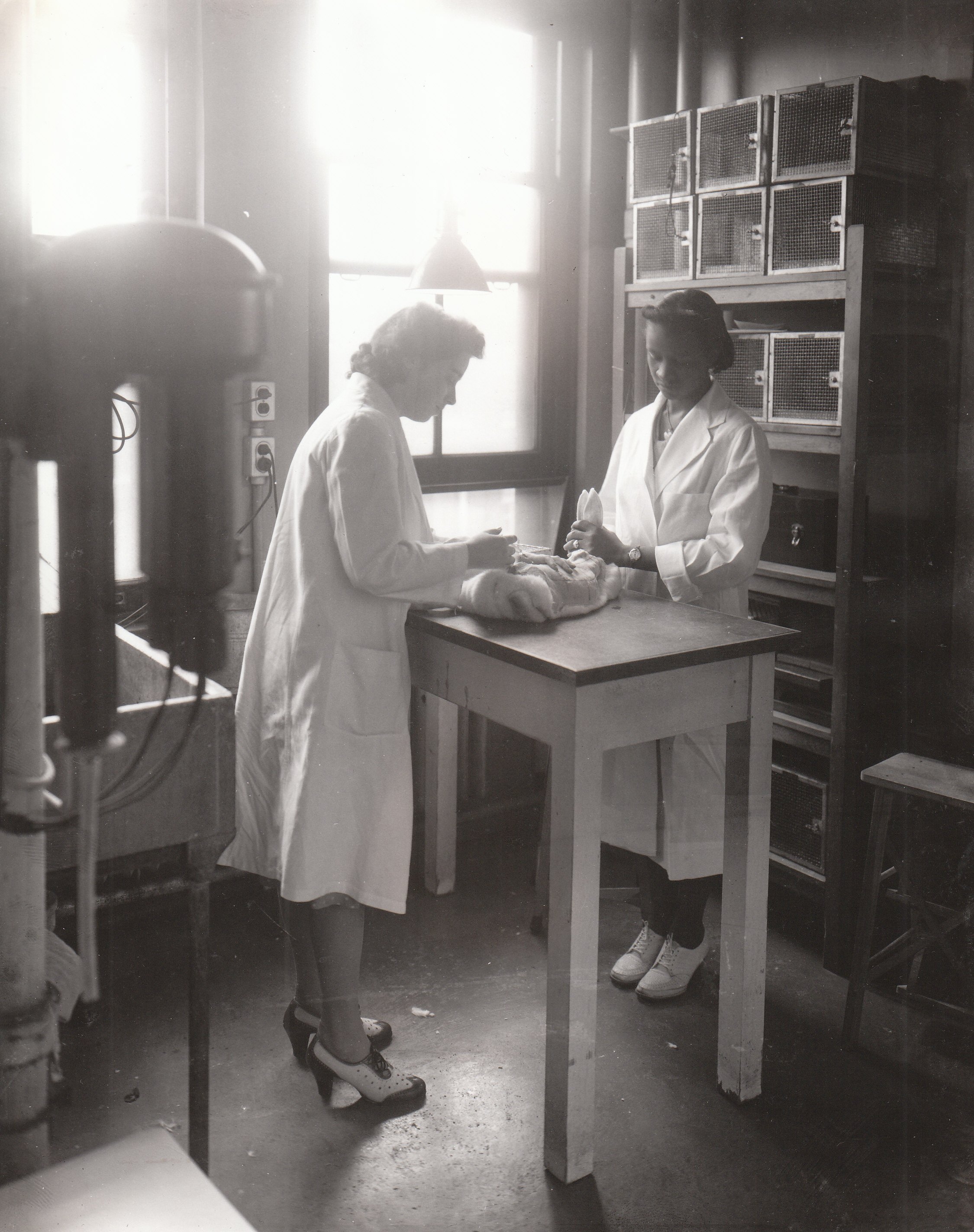

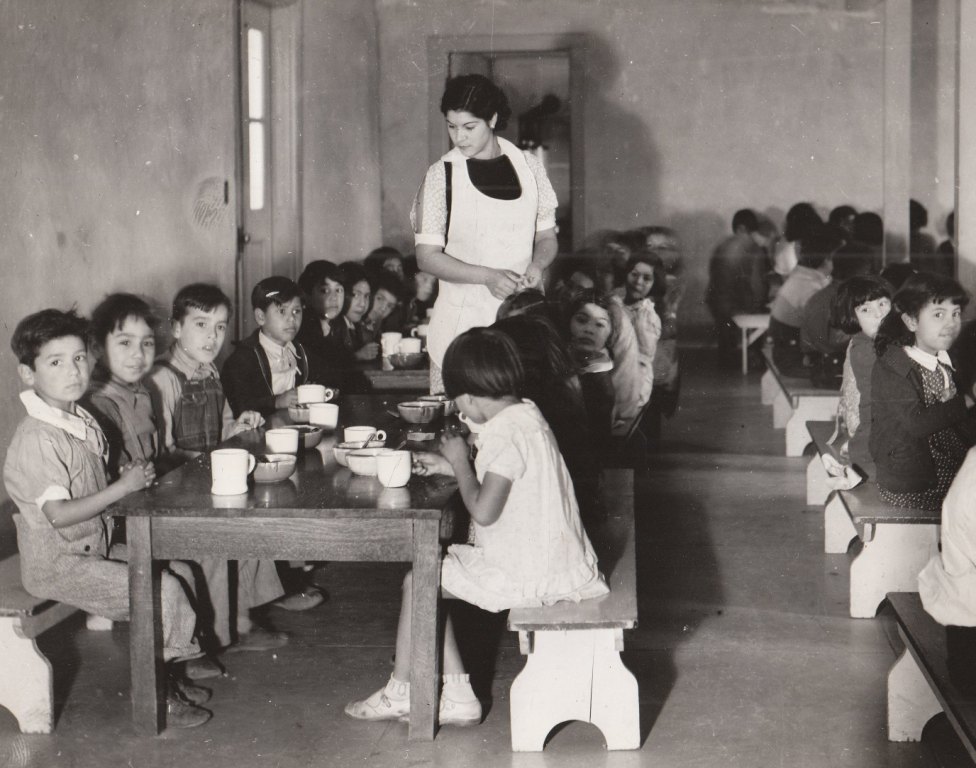

Before the New Deal, the care of Older Americans was almost entirely in the hands of family members, with some help from charitable organizations that set up old-age homes for the poor. That changed dramatically in the 1930s under the Administration of President Franklin Roosevelt. In his 1944 State of the Union address, popularly known as his Second Bill of Rights, President Franklin Roosevelt advocated for the right of all Americans to be free “from the economic fears of old age” [1]. This was a reflection of the benefits already established, or put in motion, by the New Deal, and also a declaration of intent to bolster the standard of life for Older Americans into the future.

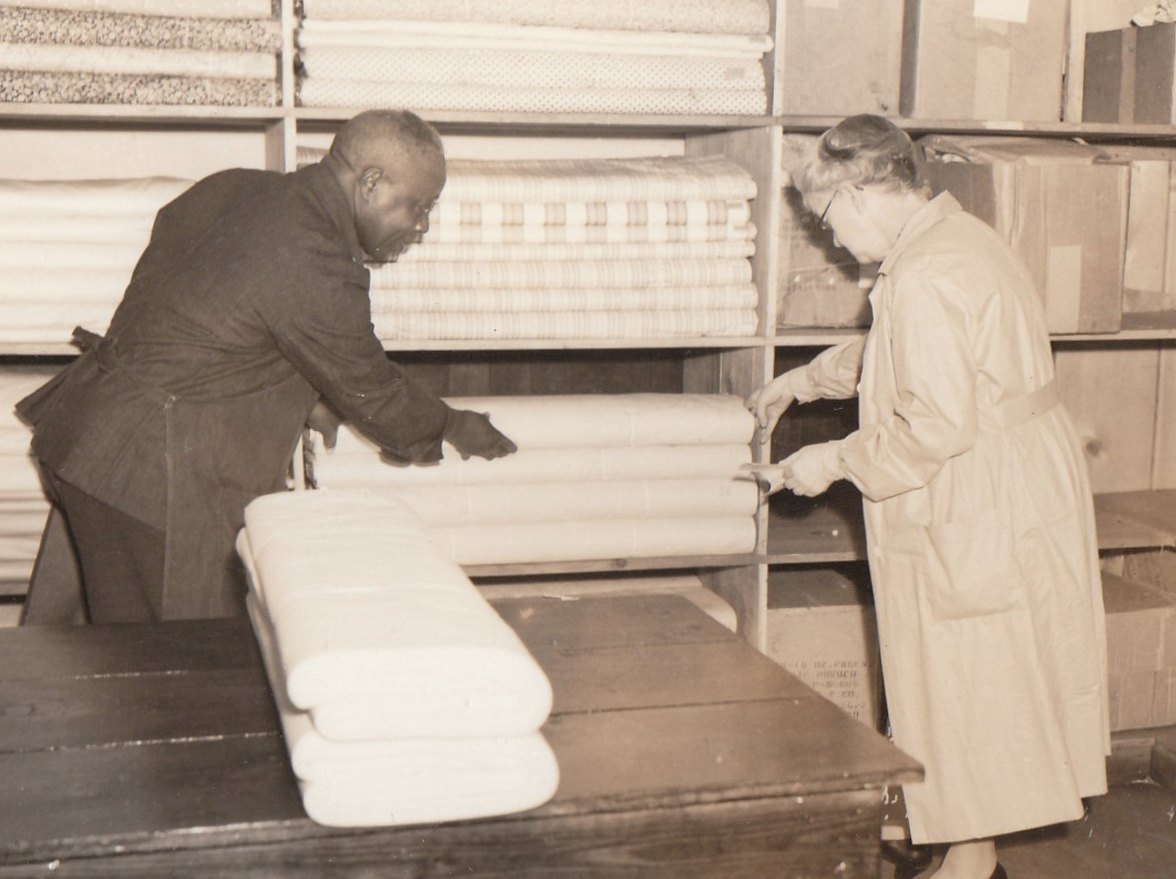

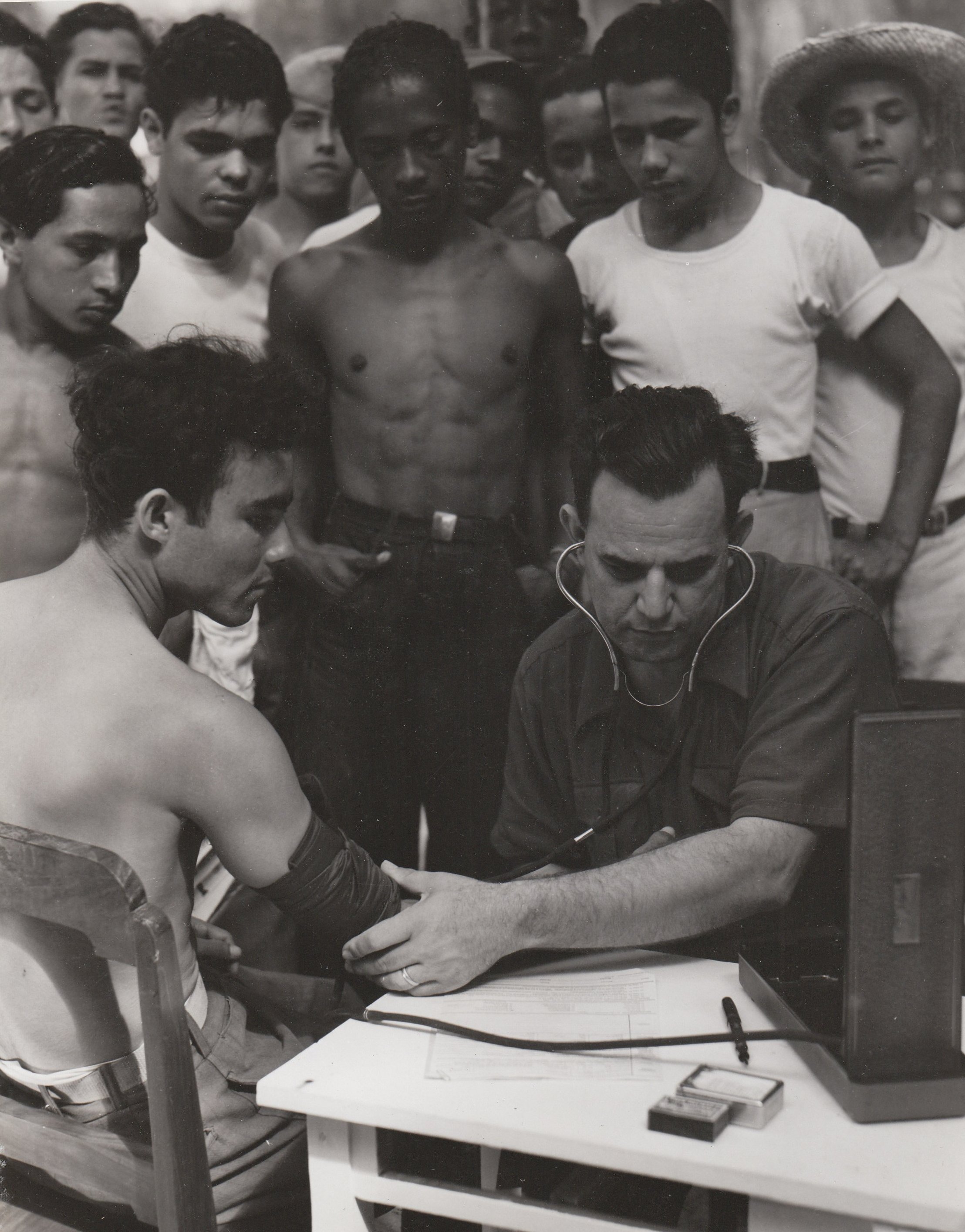

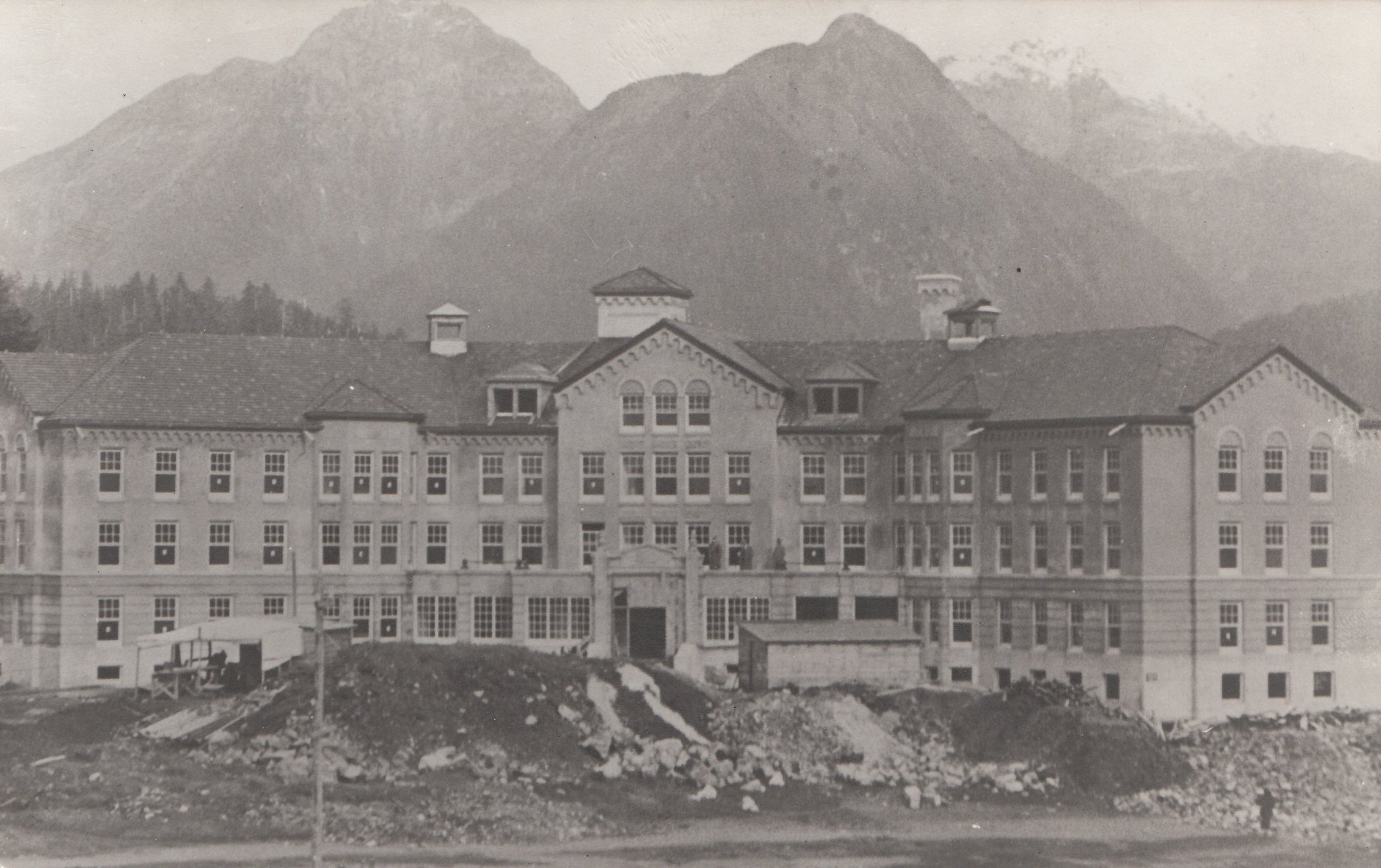

Some of the benefits of New Deal programs for Older Americans were immediate, such as the protection of life savings by the Federal Deposit Insurance Corporation; recovery of defaulted home mortgages through the work of the Home Owners Loan Corporation; distribution of surplus goods and food through the Department of Agriculture; and housing provided for the elderly in low-income projects under the United States Housing Act of 1937.

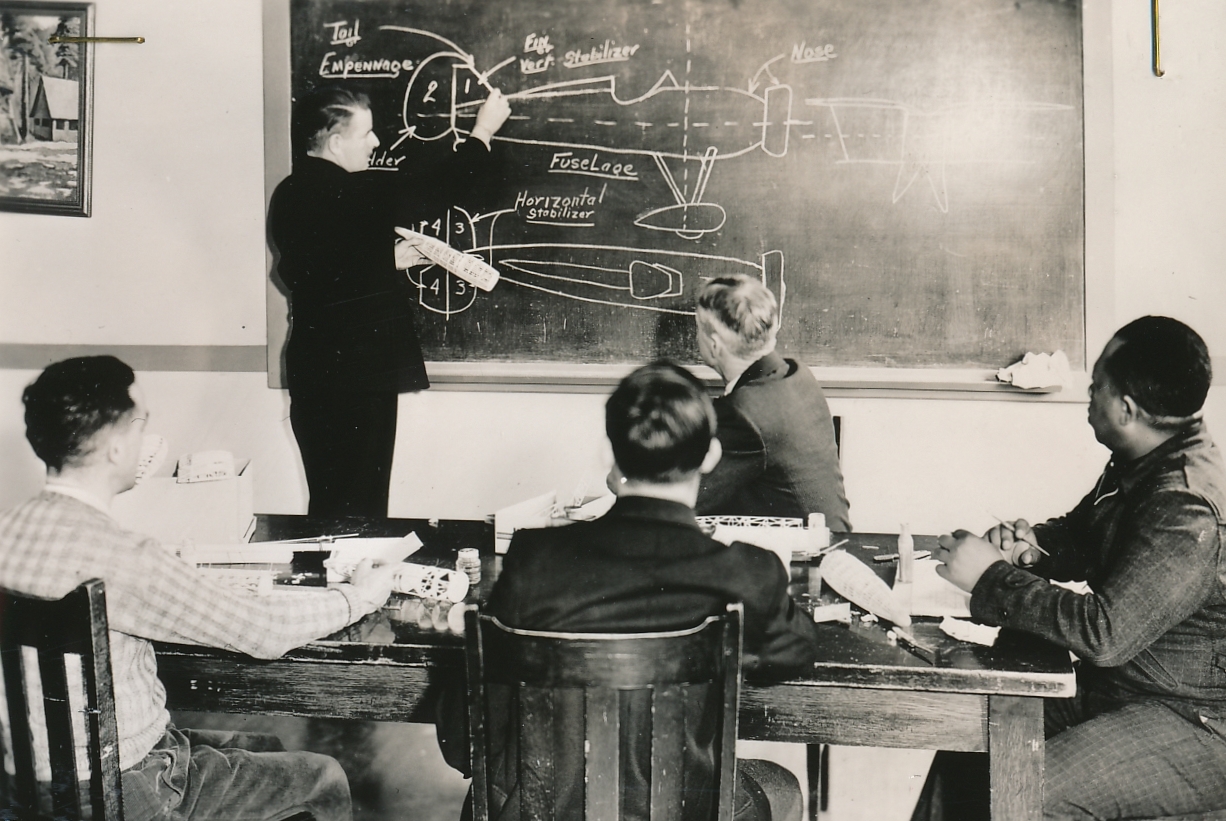

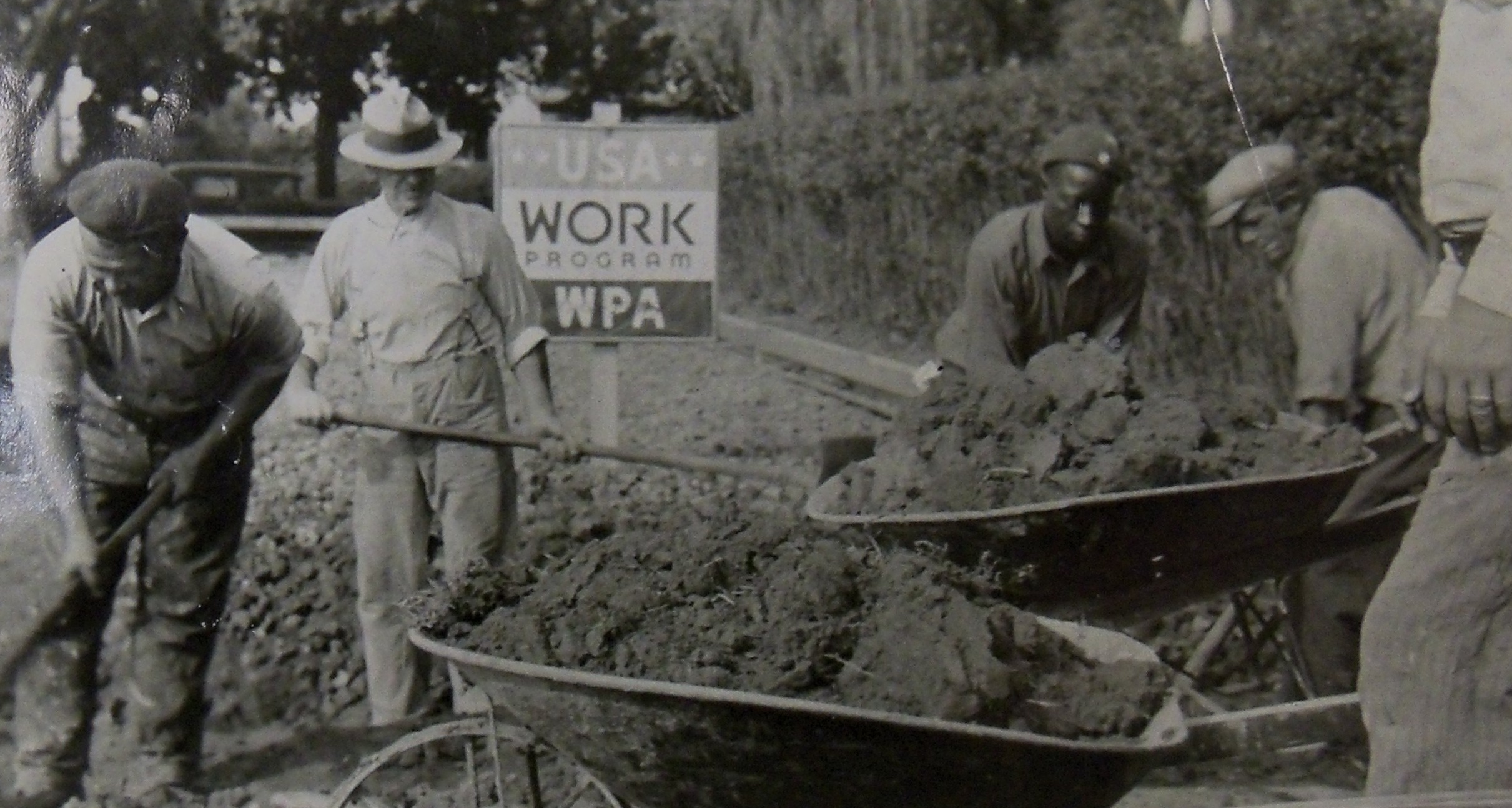

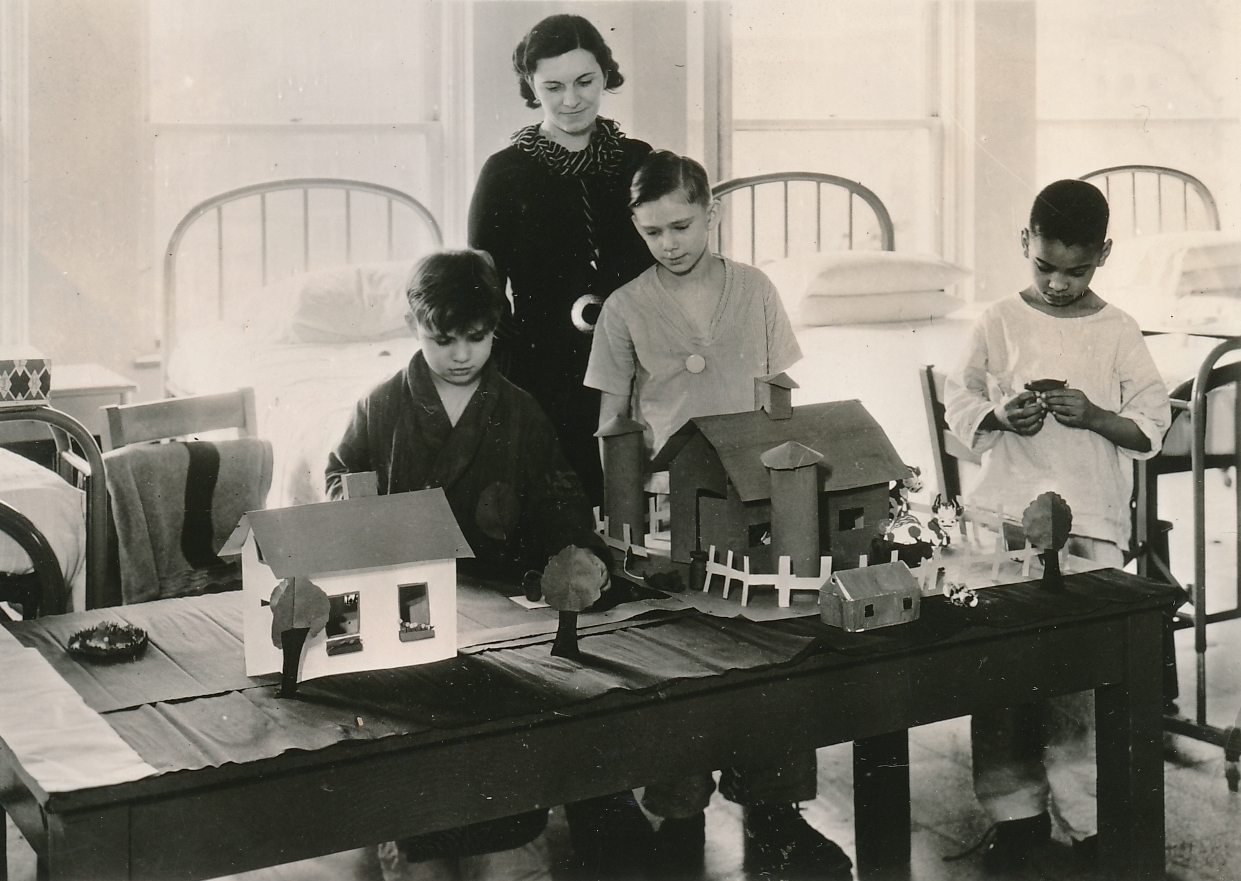

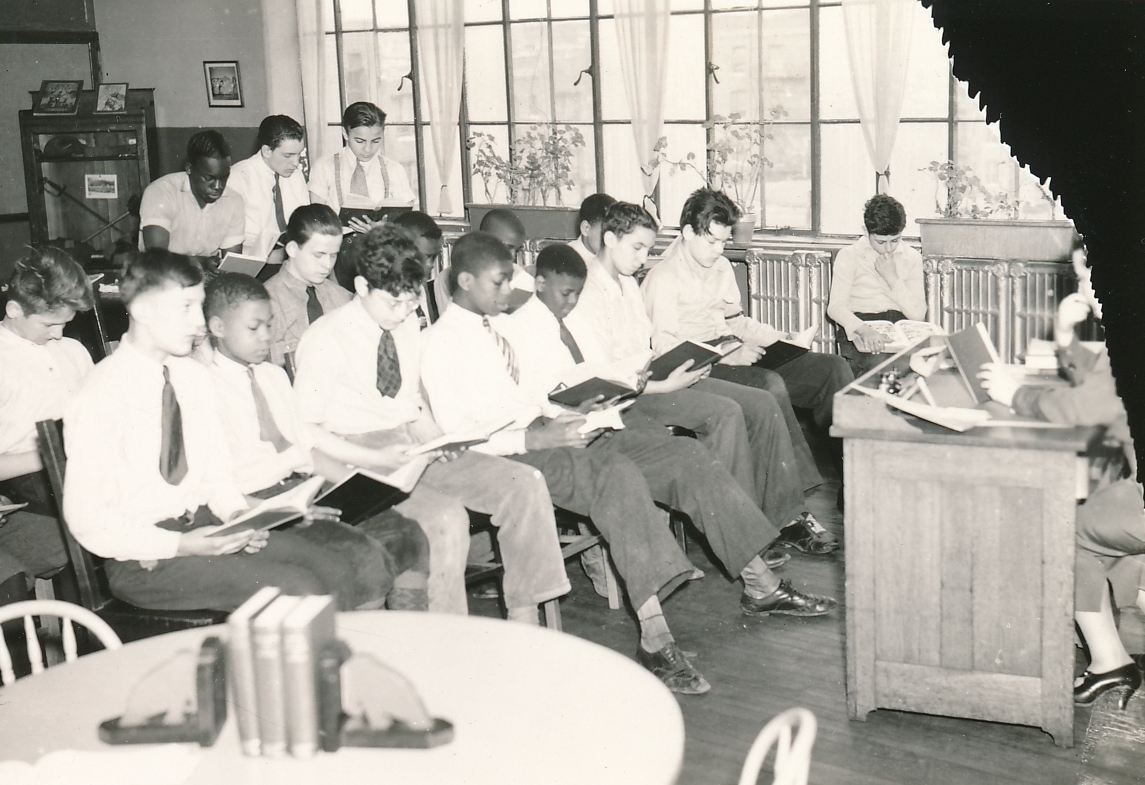

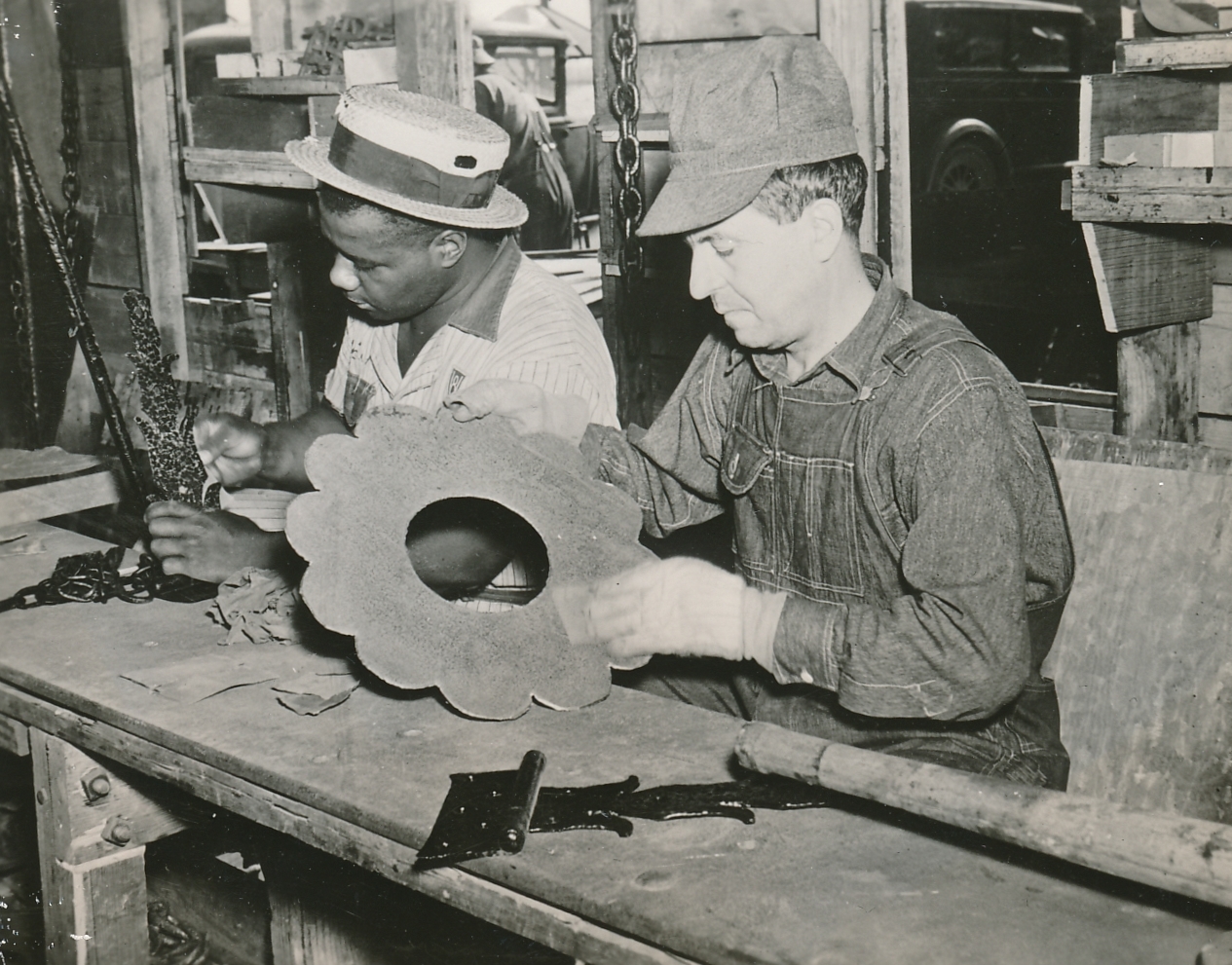

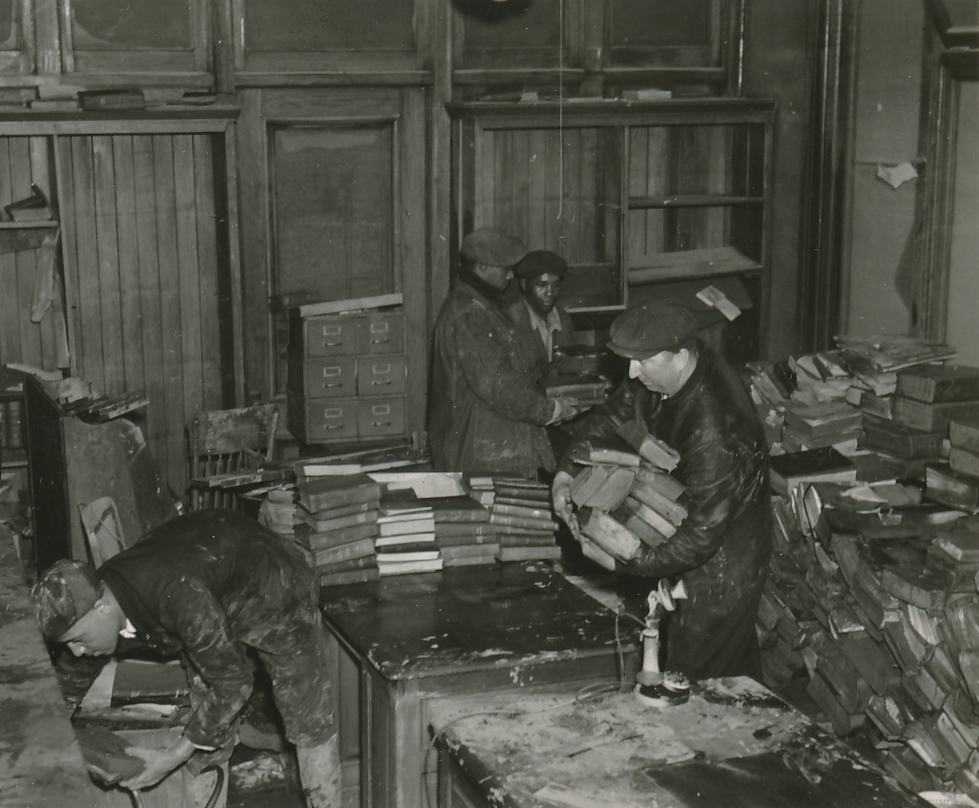

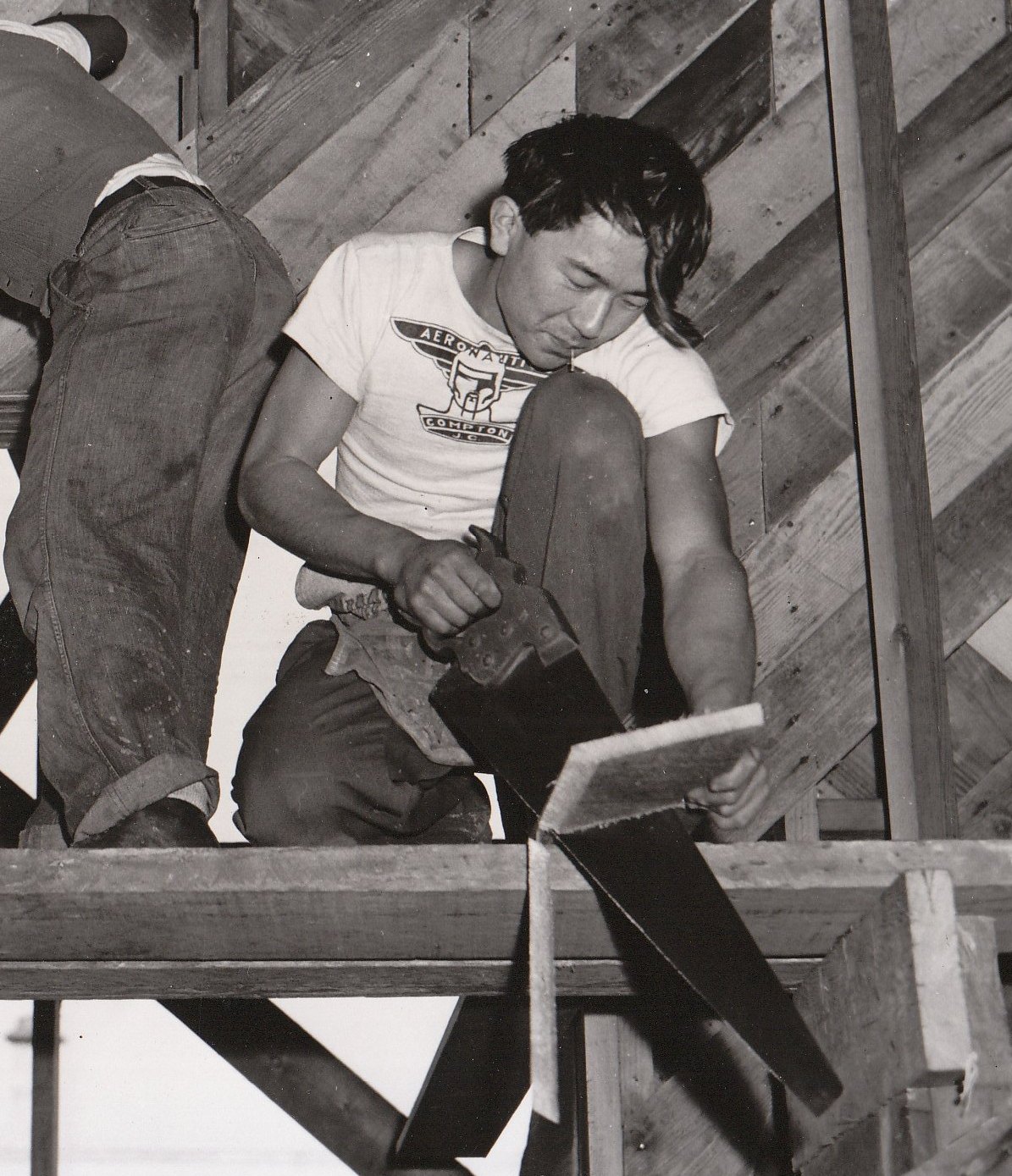

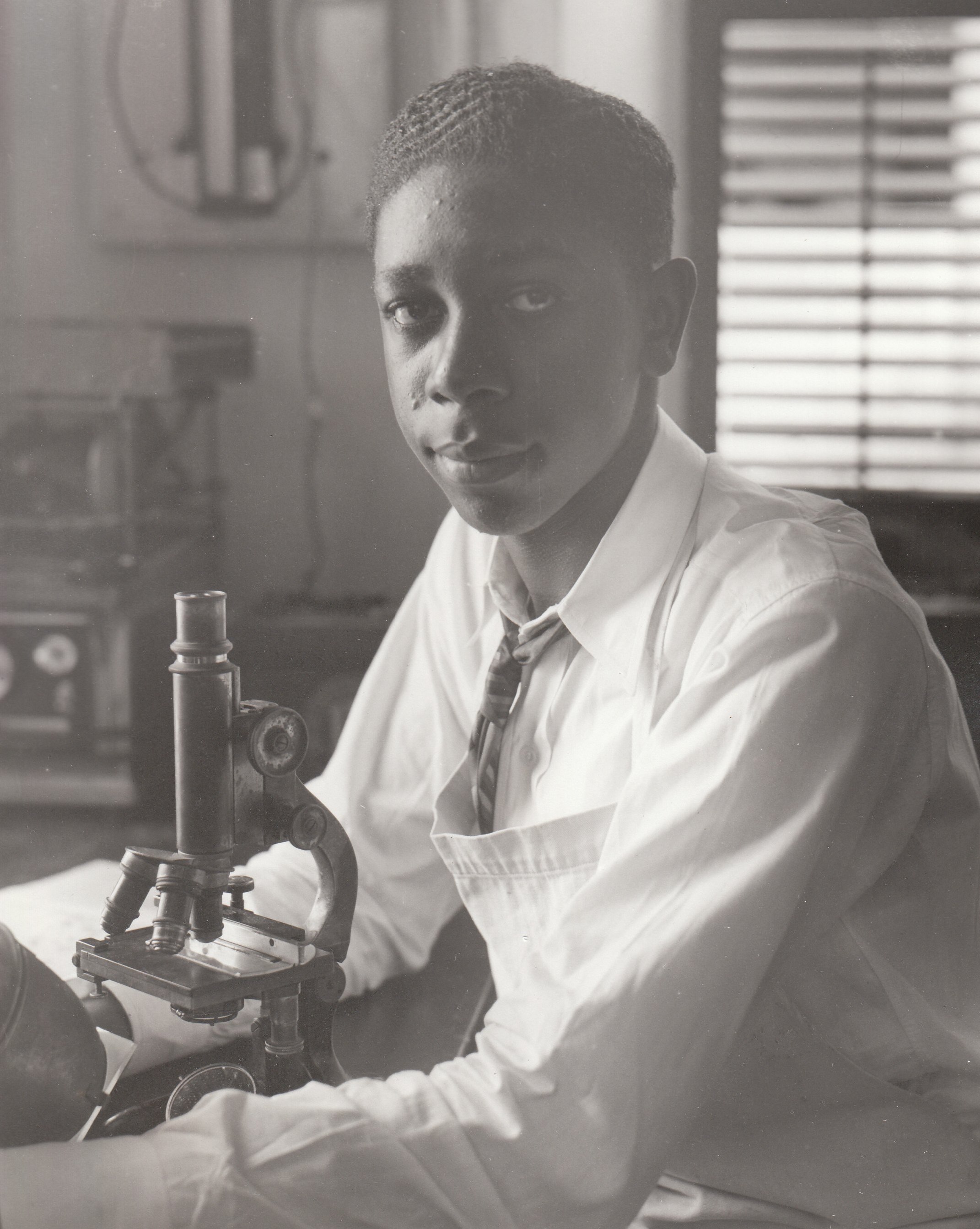

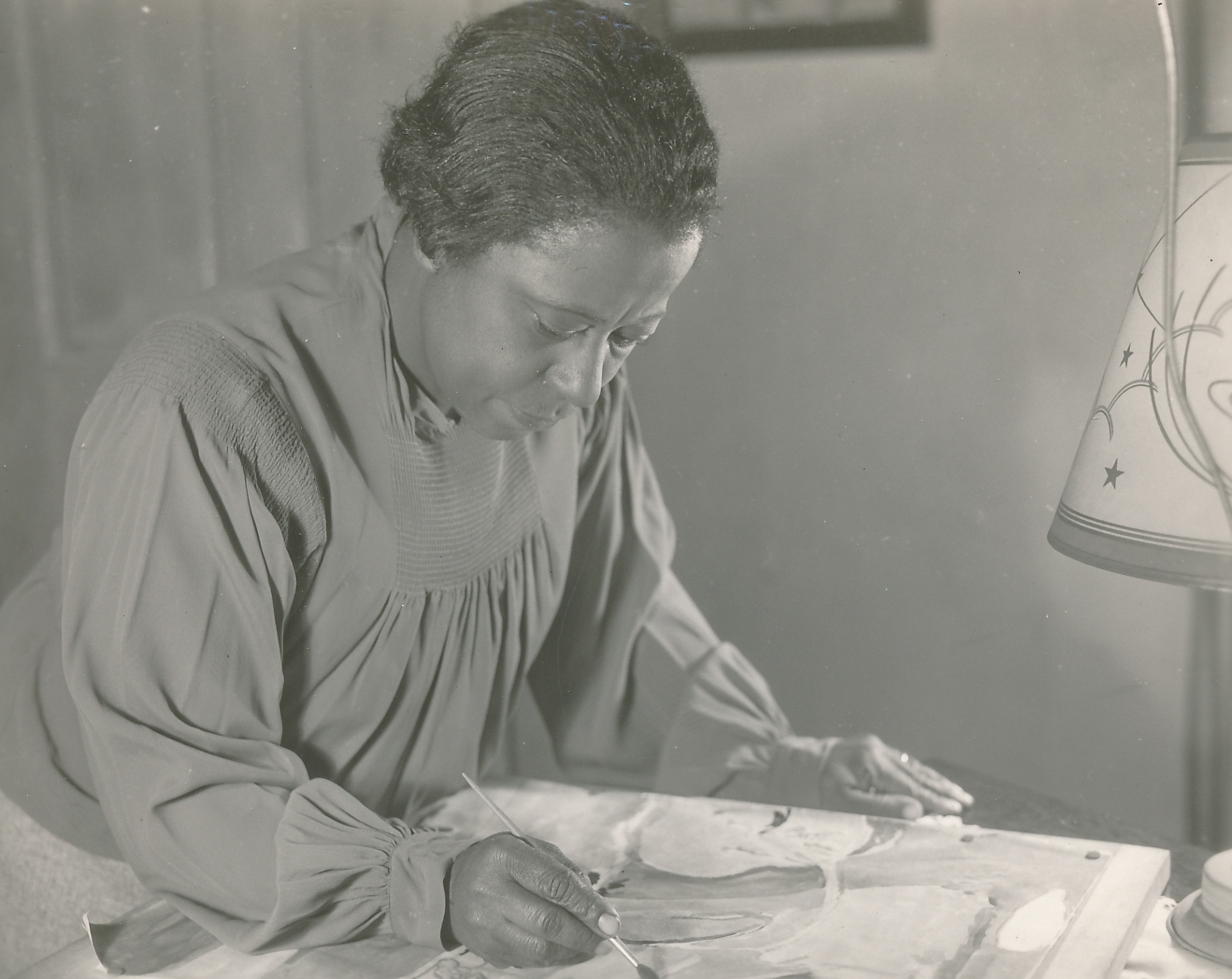

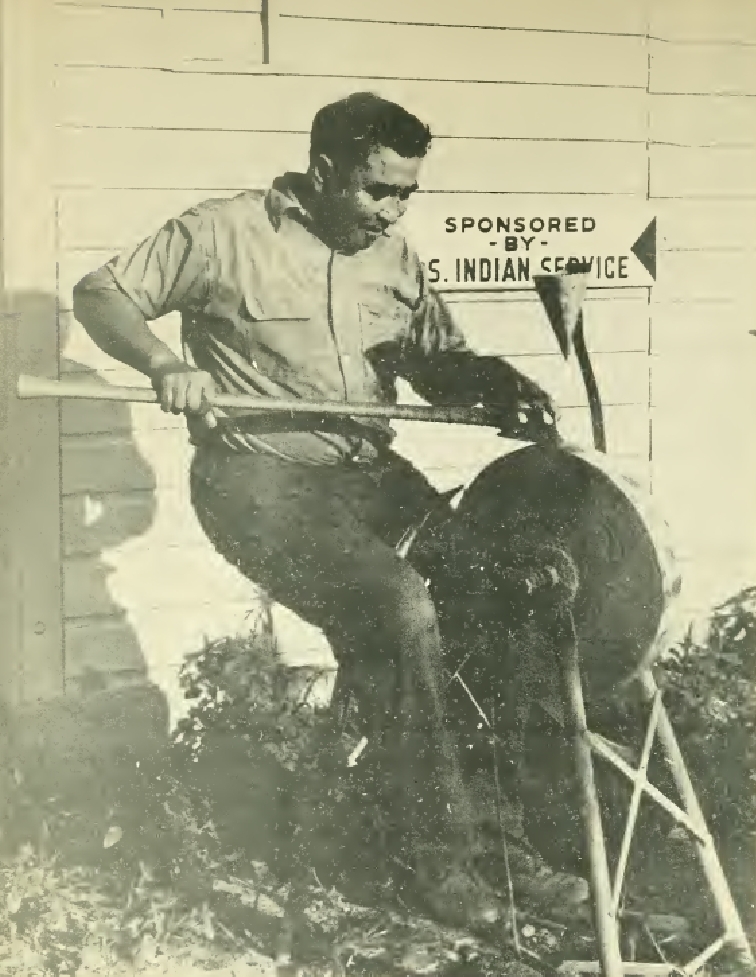

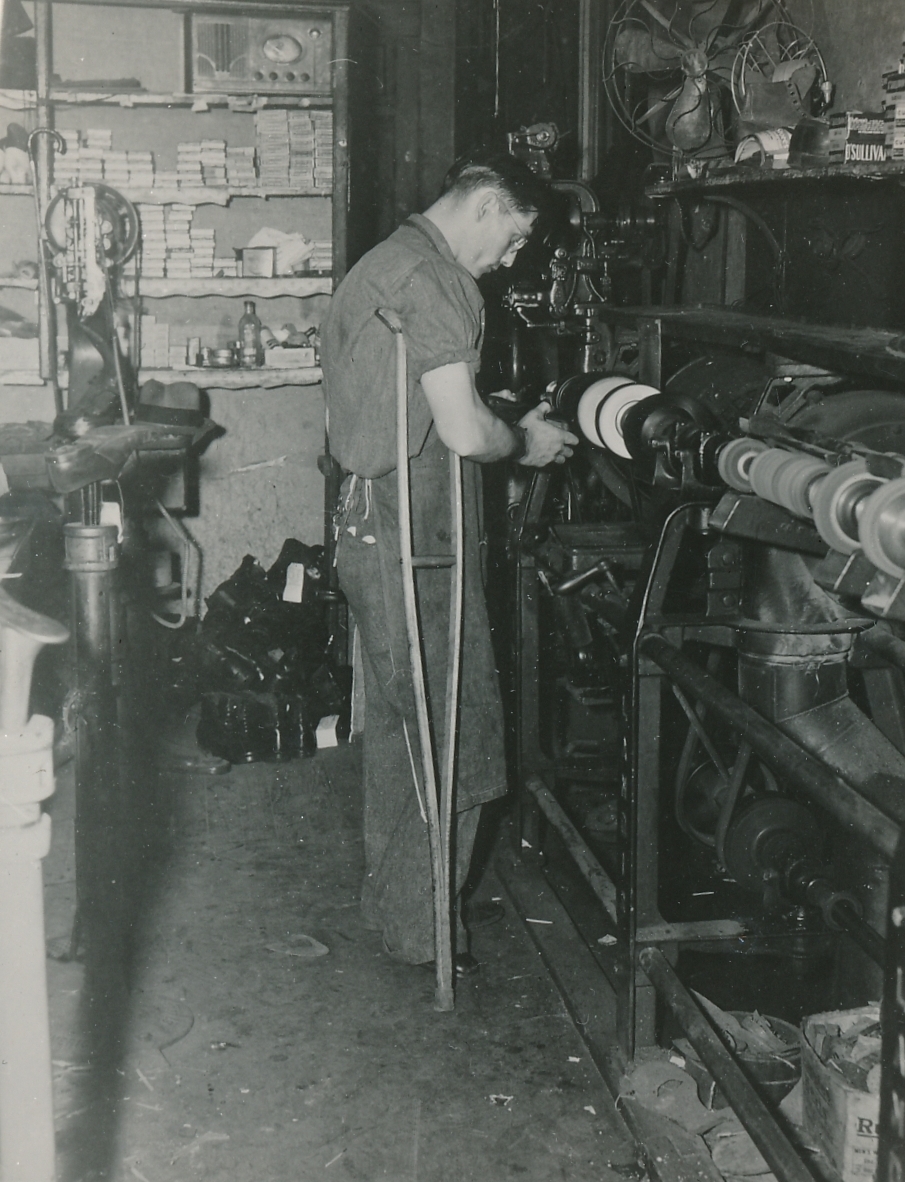

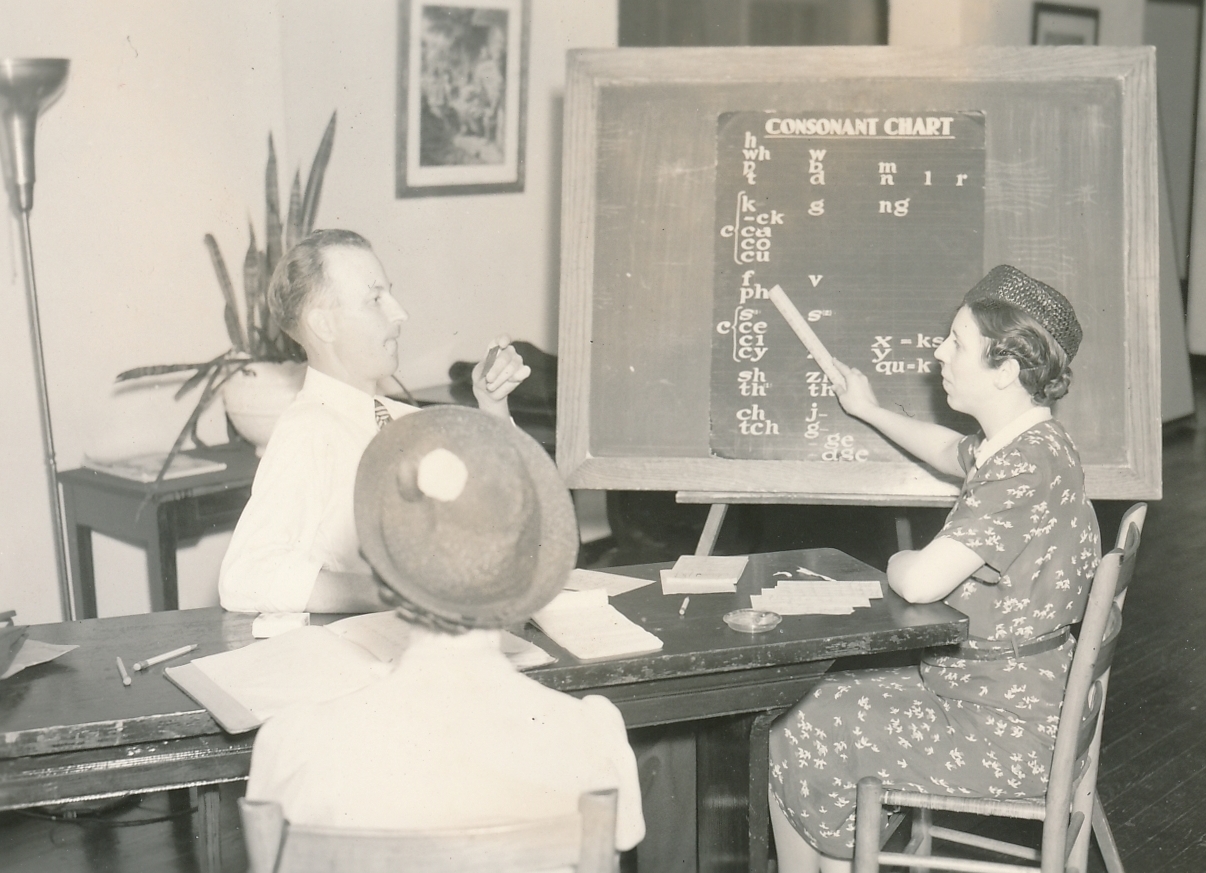

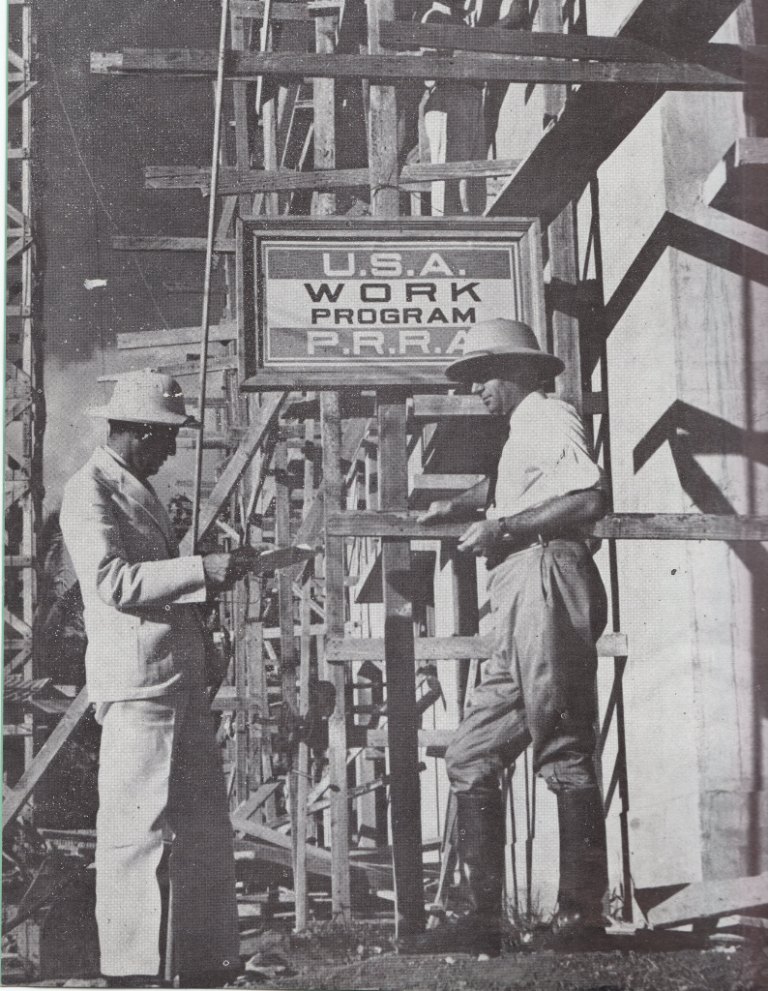

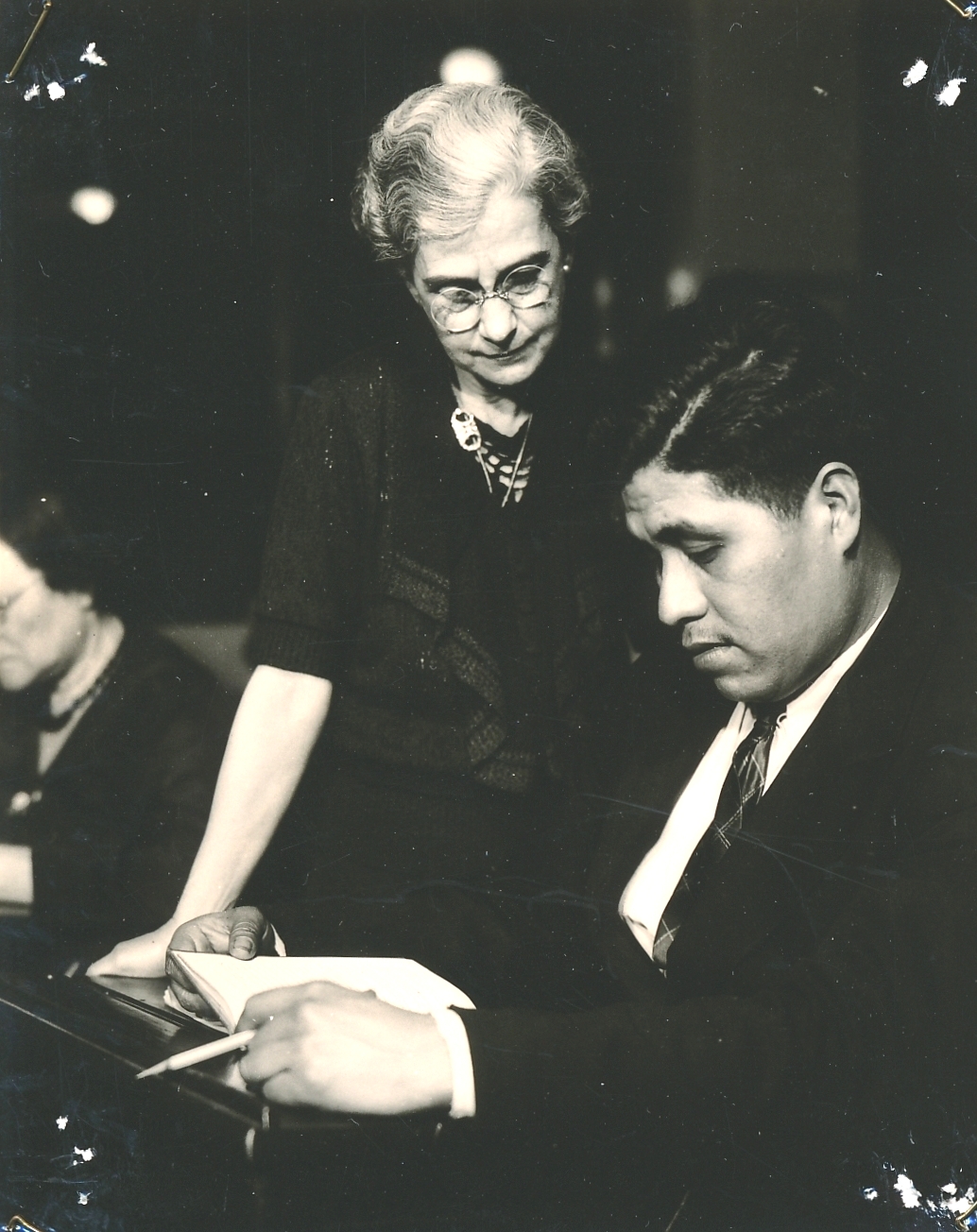

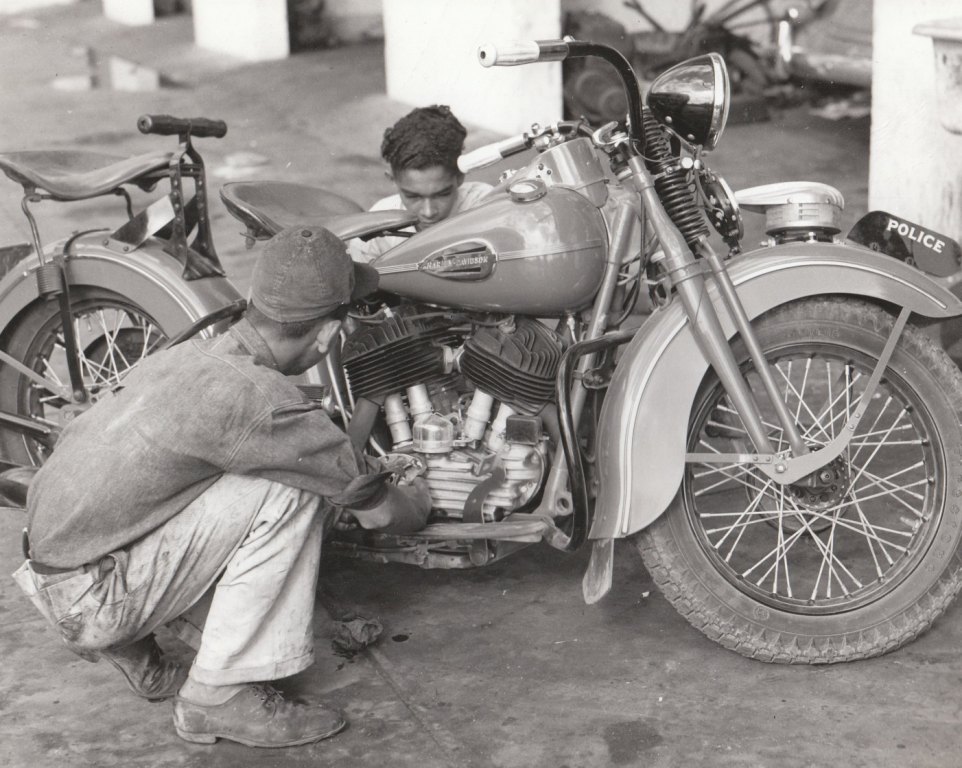

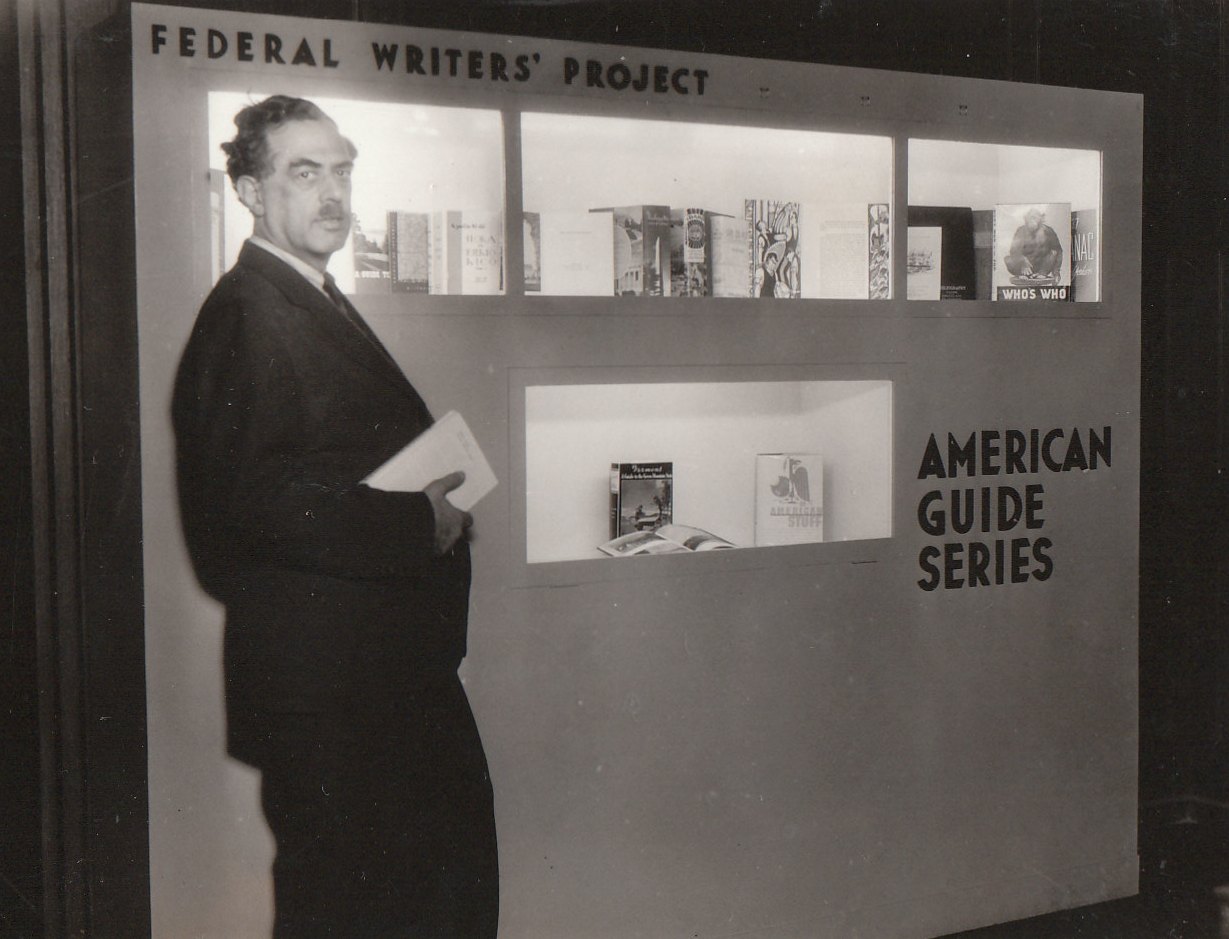

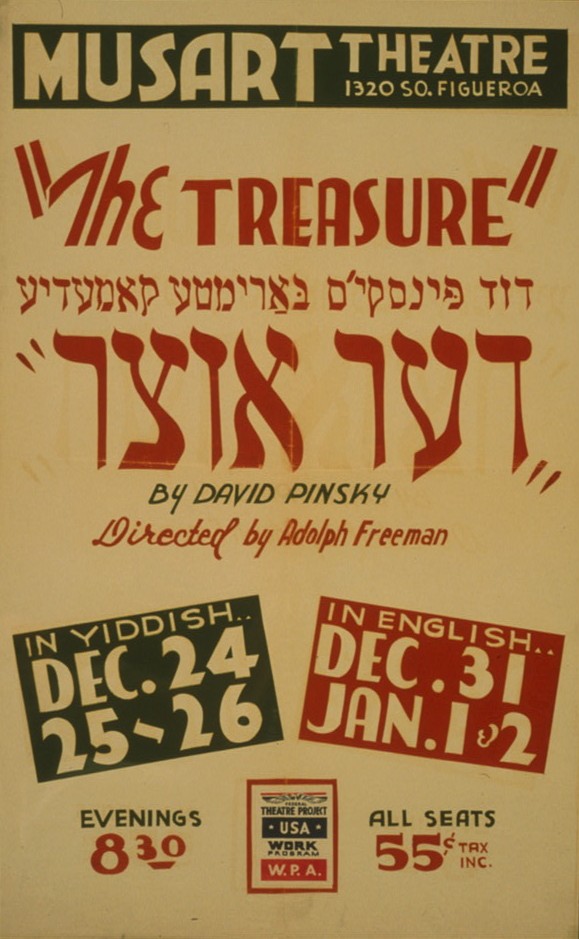

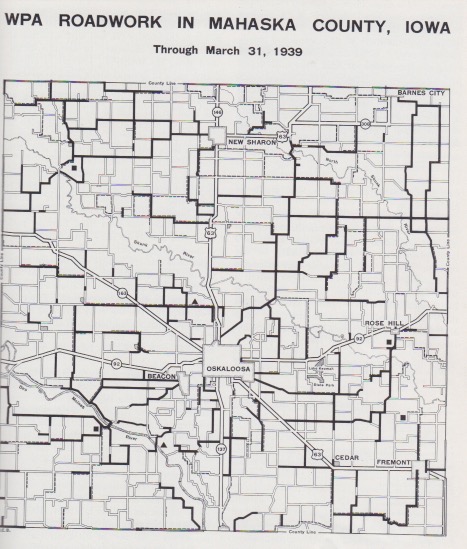

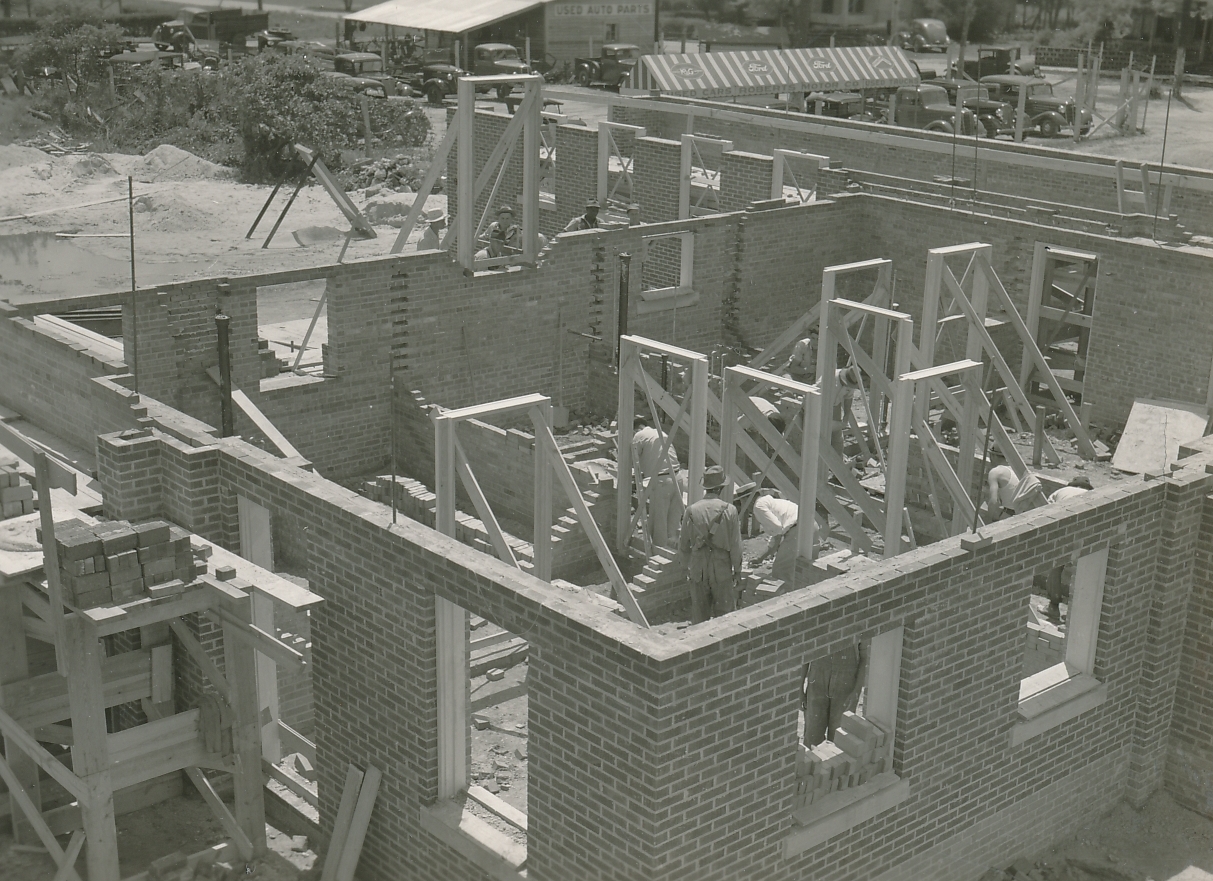

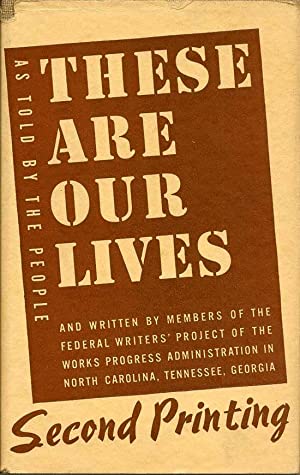

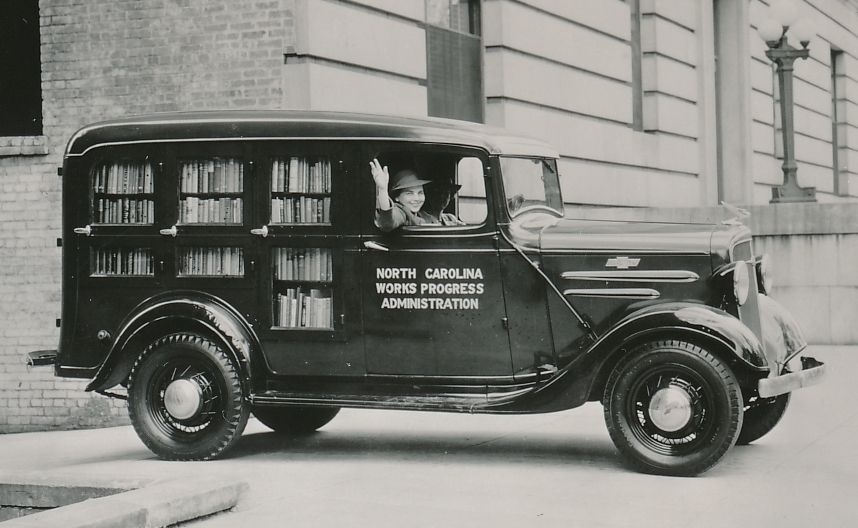

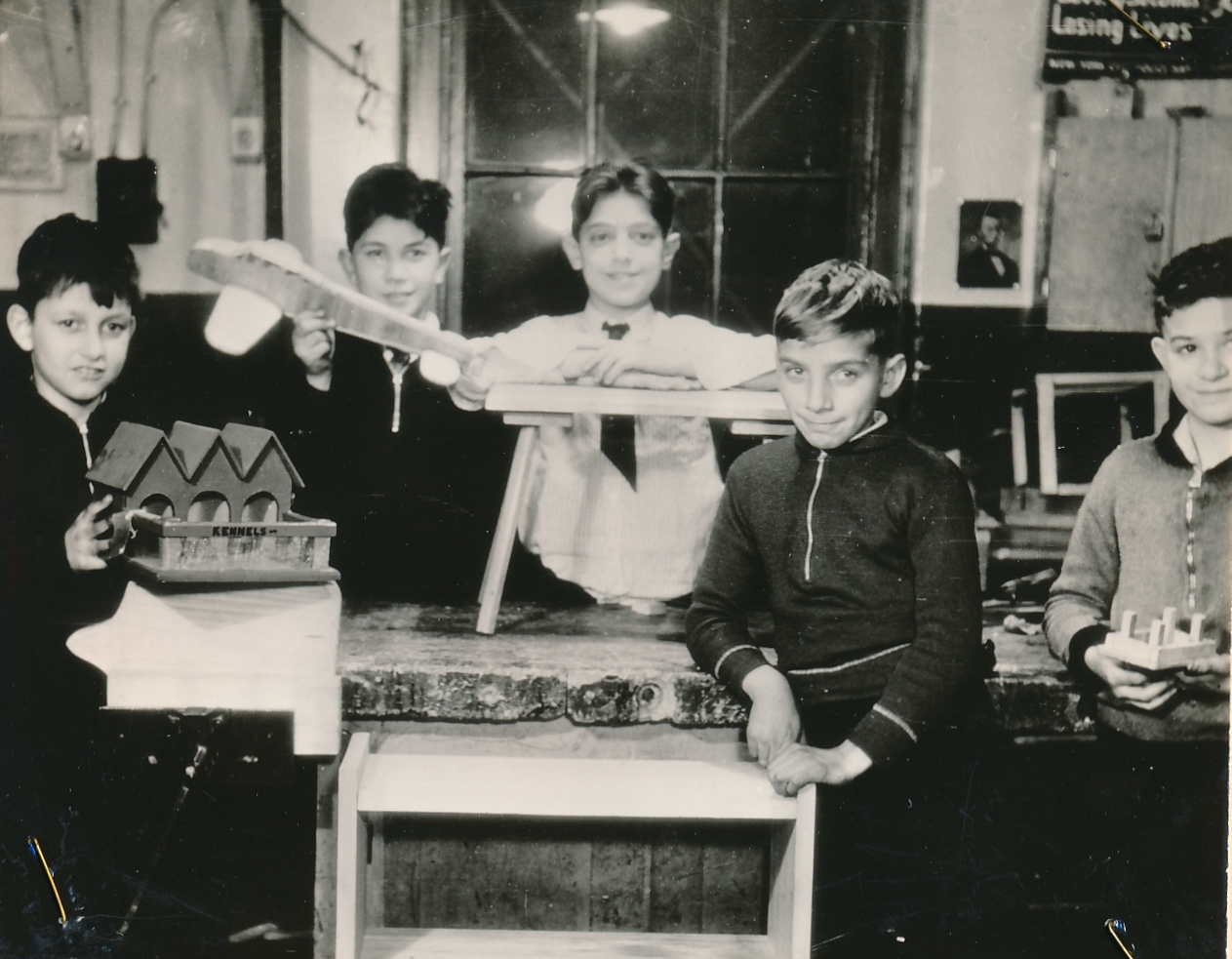

A great number of older workers (45 and over) found jobs in work-relief programs like the Works Progress Administration (WPA). For example, in late 1937over 40% of WPA workers were between the ages of 45 and 64. Yet only about 3% of WPA workers were 65 and above. This small percentage derived from three things: the strenuous nature of most WPA manual labor jobs; some old-age assistance that disqualified people from work-relief; and the much lower share of Americans over 65 in the 1930s – roughly 6% versus today’s 14% [2].

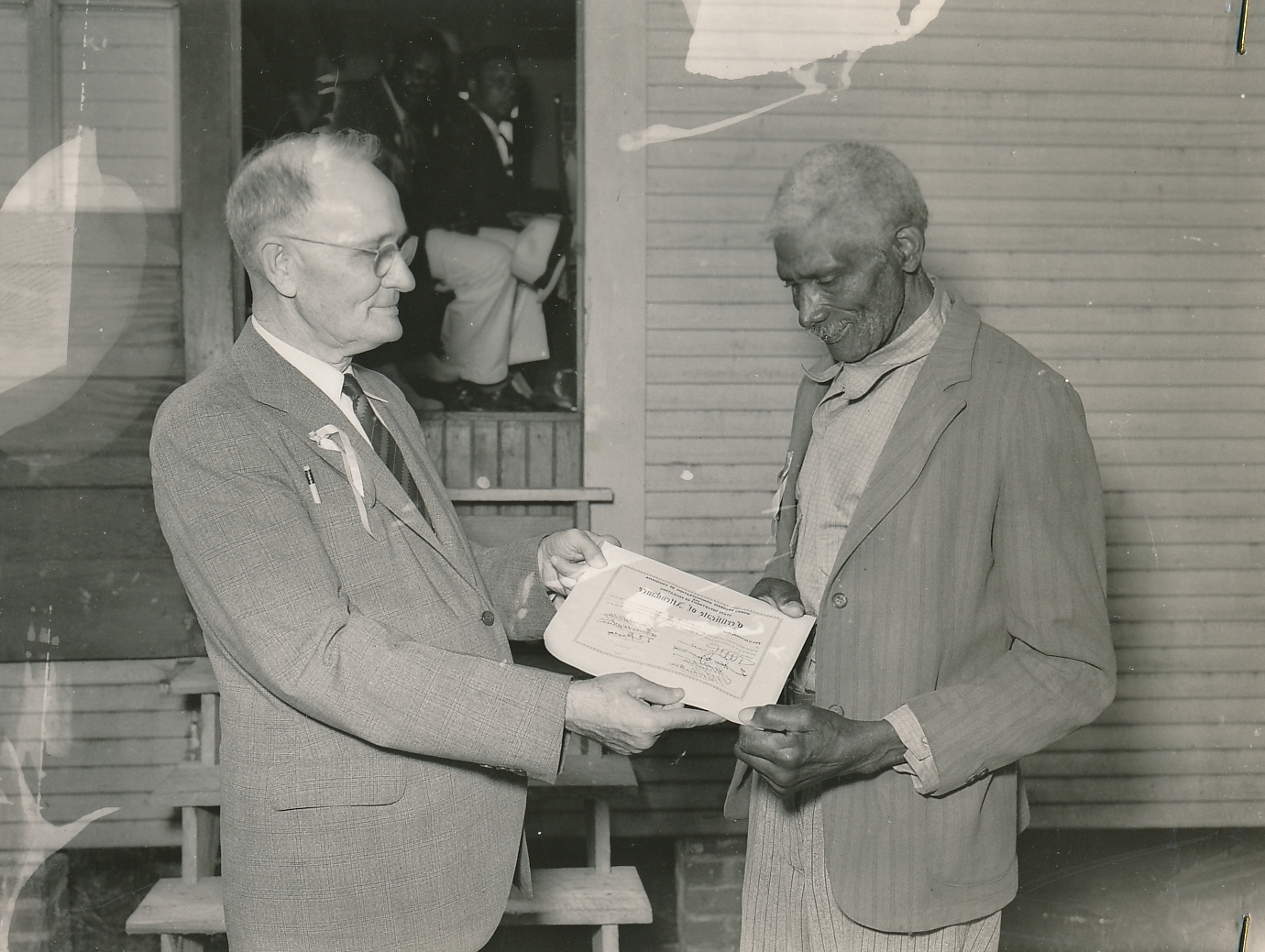

Other benefits that Older Americans received from the New Deal took longer to accrue, but profoundly improved their prospects long after the Roosevelt administration. The first monthly Social Security retirement checks were issued in 1940, and have continued ever since, with cost of living increases since the 1960s [3]. The Wagner Act of 1935 strengthened unions and allowed workers to negotiate for better pensions in the postwar era [4]. The Federal Housing Act of 1934 led to the standardization of the 30-year mortgage, which allowed for vastly more families to buy homes over the coming decades [5]. During the second half of the twentieth century, Social Security, pensions, and home ownership were the pillars of America’s old-age security system. Better financial security contributed substantially to the lengthening life expectancy of Older Americans over the 20th century.

Unfortunately, the situation for Older Americans has deteriorated in recent years, for several reasons. One is a Reagan-era increase in the Social Security benefits age [6]; another is the weakening of unions, breaking of contracts and defaults on corporate and city pension plans [7]; and a third is widespread loss of homes by elders through foreclosure by predatory lenders [8]. As for the young, their prospects for Old Age security have been diminished by student debt burdens, rising house prices that have suppressed home ownership rates [9], and stagnant wages that prohibit significant savings [10]. The worsening state of pensions and retirement today [11] highlights the importance – and revolutionary nature – of New Deal-era policies for Older Americans.

Sources: (1) “State of the Union Message to Congress, January 11, 1944,” Franklin D. Roosevelt Library and Museum (accessed April 5, 2018). (2) Donald S. Howard, The WPA and Federal Relief Policy, New York: Russell Sage Foundation, 1943, pp. 271-277; and “The Older Population: 2010,” U.S. Census Bureau, November 2011 (accessed June 18, 2018). (3) “Frequently Asked Questions,” Social Security Administration (accessed April 5, 2018). (4) See our summary of the Wagner Act. (5) See our summary of the National Housing Act. (6) Social Security: A Program and Policy History,” Social Security Administration (accessed April 5, 2018); on the continuing pressure to raise the retirement age, see “The retirement age for Social Security needs to rise to 70,” MarketWatch, November 7, 2016, and “Republican Study Committee Releases FY 2019 Budget: A Framework for Unified Conservatism,” Republican Study Committee, Press Release, April 25, 2018. (7) See, e.g., “Union Membership Rate in U.S. Held at Record Low of 10.7% in 2017,” Bloomberg, January 19, 2018. (8) “Trump’s Treasury Pick Excelled at Kicking Elderly People Out of Their Homes,” ProPublica, December 27, 2016 (9) See, e.g., “These are the ways student loans stop people from buying a house,” CNBC, March 31, 2018. (10) See, e.g., “6 in 10 Americans don’t have $500 in savings,” CNN Money, January 12, 2017. (11) See, e.g., “The State of American Retirement: How 401(k)s have failed most American workers,” Economic Policy Institute, March 3, 2016, and “Government report sounds alarm on retirement crisis,” CNBC, October 19, 2017.